With effect from 1 Jan 2015 the tax on capital gains made when selling immovable property situated in Malta will be replaced (save for a few exceptions) with a transaction tax on property transfers.

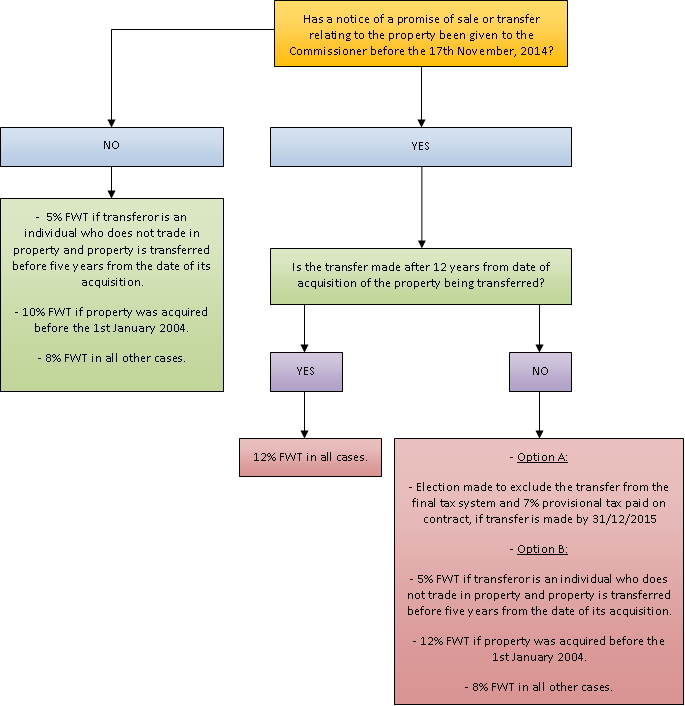

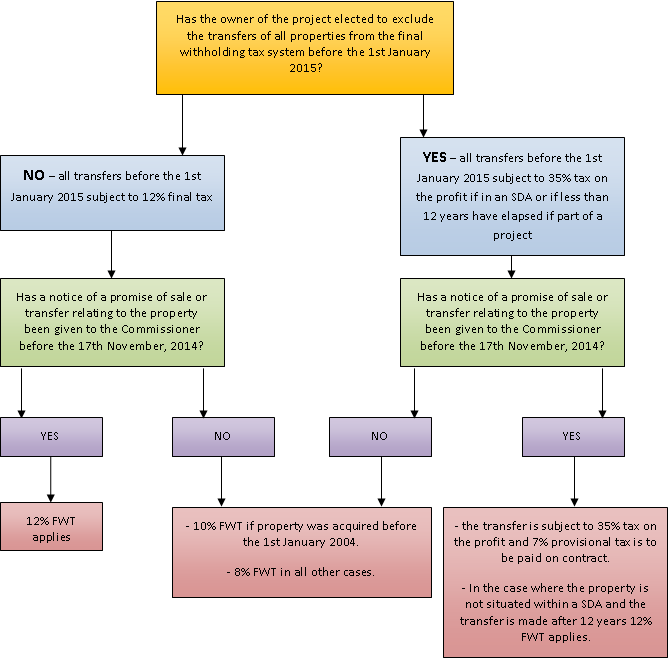

If you are not sure of how this will work or would like to familiarize yourself with how it will work we are here reproducing a flow chart issued by the Inland Revenue to help you understand how it will work.

Gains made on inherited immovable property remain subject to a Final Witholding Tax of 12% on the difference between the transfer value and the cost of acquisition (denunzja). Where the property was inherited before 25 Nov 1992 final tax of 7% on the consideration is levied.

The first flowchart refers to transfers of any property that do not form part of a project or SDA (special designated area).

The second relates to properties forming part of a project or situated within an SDA (existing before 1 Jan 2015).

Feel free to contact us if this is not clear or does not answer your query.

I – Applicable to stand alone properties (outside SDA)

II- Applicable to projects within an SDA or part of a project

(Checklist issued by the Director General of Inland Revenue)